Interested in financing

your machine?

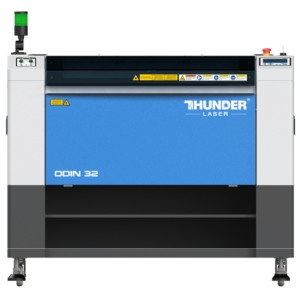

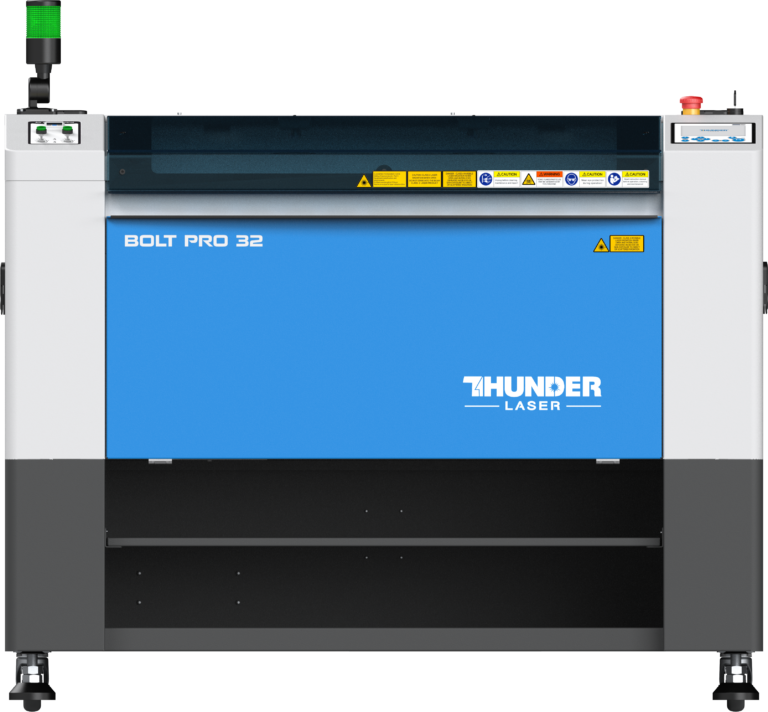

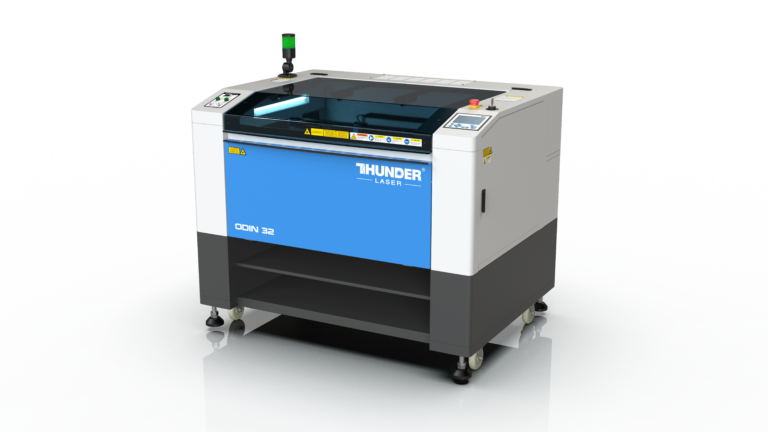

Great value for every Creator

Find the right machine at the right price

Premium products without the premium cost

What’s pricey, unreliable, and outdated? Not our laser machines, that’s for sure.

At Thunder Laser, we support your creative ventures and financial goals, and our products reflect that. Instead of inflating costs and trying to oversell you on some fancy features you’ll probably never use, we want to make sure you’re getting exactly what you need from our machines.

Most makers only use 80% of the features in their laser engraving systems. With Thunder Laser, our experts talk to you, learn what you need, and help you select the best model for you—without any hidden fees or costs.

Still convinced you need all the bells and whistles laser technology could possibly offer? Our Nova 63 will get you all that for far less than you’d expect.

Does this sound too good to be true? Reach out and we’ll prove it.

Finance options for you

Interested in financing your machine? We can help.

We know launching and growing a small business can be expensive. Through our partnership with Geneva Capital, we can help you get the equipment you need to get the job done. Together, we take the time to get to know you and your business. And we’ll make every effort to get you approved for financing with the best possible terms.

The process is easy. Spend five minutes filling out the online credit application, then Geneva Capital will get back to you with the decision in one business day.

What you can expect

A trustworthy Lender who works for you

Fast, convenient finance solutions for businesses of all sizes—including start-ups

Work with a direct lender, not a broker (they’ll never sell your agreement)

In-house credit decisions ensure each application is individually reviewed

Product knowledge—21+ years of experience in this industry

Financing options for challenged credit

Attractive pricing and fixed, flexible payments (and they’ll also help you with tax benefits)

Creative terms & structures to fit your needs

- Flexible terms

- 100% financing

- Tax-deductible lease payments

- $0 down options

- Deferred payment options

- Special structuring for start-ups